Page 11 - Microsoft PowerPoint - TBS ACC - IFRS9 - Hedge Accounting - 20181126

P. 11

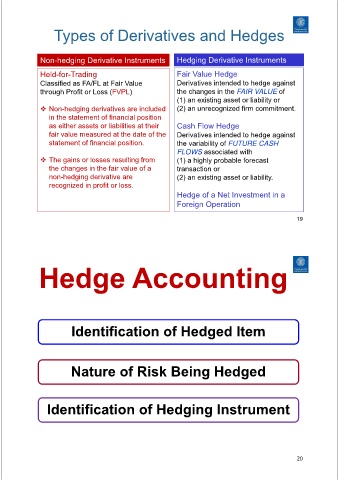

Types of Derivatives and Hedges

Non-hedging Derivative Instruments Hedging Derivative Instruments

Held-for-Trading Fair Value Hedge

Classified as FA/FL at Fair Value Derivatives intended to hedge against

through Profit or Loss (FVPL) the changes in the FAIR VALUE of

(1) an existing asset or liability or

Non-hedging derivatives are included (2) an unrecognized firm commitment.

in the statement of financial position

as either assets or liabilities at their Cash Flow Hedge

fair value measured at the date of the Derivatives intended to hedge against

statement of financial position. the variability of FUTURE CASH

FLOWS associated with

The gains or losses resulting from (1) a highly probable forecast

the changes in the fair value of a transaction or

non-hedging derivative are (2) an existing asset or liability.

recognized in profit or loss.

Hedge of a Net Investment in a

Foreign Operation

19

Hedge Accounting

Identification of Hedged Item

Nature of Risk Being Hedged

Identification of Hedging Instrument

20